Introduction

When it comes to the construction industry, contractor bonds often create a whirlwind of confusion. Many contractors and clients alike misunderstand what these bonds entail, particularly regarding their costs. This article aims to clarify the common misconceptions about the cost of contractor bonds, providing clarity for those navigating this essential aspect of contracting. We'll explore various facets of bonding insurance for contractors, debunk myths, and offer insight into how you can manage and anticipate these costs effectively.

Understanding Contractor Bonds

What Are Contractor Bonds?

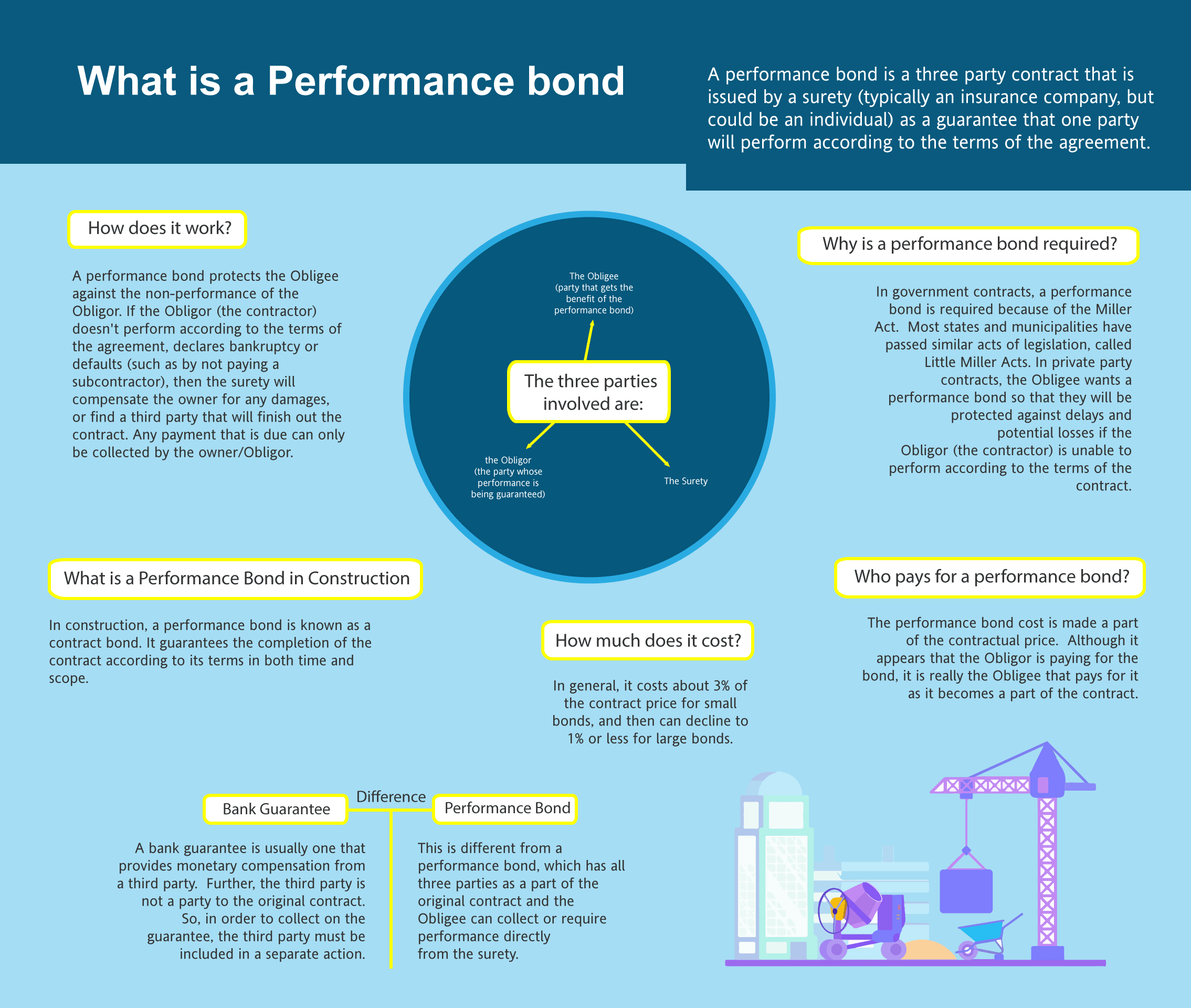

Contractor bonds are a type of surety bond that ensures compliance with contract terms and protects project owners from losses resulting from a contractor's failure to fulfill their obligations. Essentially, how performance bonds work they act as a safety net in the construction realm.

Types of Contractor Bonds

Performance Bonds: Guarantee that a contractor will complete the job according to the contract specifications. Payment Bonds: Ensure that subcontractors and suppliers get paid. License and Permit Bonds: Required by state or local governments to ensure compliance with regulations.The Role of Bonding Insurance for Contractors

Bonding insurance for contractors provides an additional layer of protection, ensuring that your business is safeguarded against financial losses due to non-compliance or failure in project execution.

Common Misconceptions About the Cost of Contractor Bonds

Myth 1: Contractor Bonds Are Only for Large Projects

Many believe that contractor bonds are only necessary for large-scale projects, but that's not true. In reality, any project requiring a bond—no matter its size—poses risks that these bonds can mitigate.

Myth 2: All Bonds Cost the Same

Not all bonds come with identical price tags. Factors such as creditworthiness, project size, and bond type play significant roles in determining costs.

Myth 3: The Bond Amount Equals Actual Costs

Some assume that if a bond is set at $500,000, that's how much they'll pay out-of-pocket. Instead, contractors typically pay only a percentage (often between 1% to 3%) of the bond amount as a premium.

Factors Influencing Bond Costs

Credit Score Impact on Bond Premiums

Your credit score is one critical factor affecting your bonding premiums. A higher score usually leads to lower rates due to perceived reliability.

Project Size and Scope Considerations

Larger projects often require larger bonds; thus, understanding how size impacts cost is essential for budgeting effectively.

Industry Risk Levels Affecting Pricing

Different industries carry different risk levels which influence bonding rates. Construction has unique challenges that must be factored into pricing models.

Understanding Bond Premiums: What You Need to Know

How Are Bond Premiums Calculated?

Bond premiums are generally calculated based on:

- The total amount required for the bond. The contractor's credit profile. Project specifics including risk factors.

Average Costs of Contractor Bonds in Different Industries

| Industry | Average Premium Rate | Typical Bond Amount | |----------------|----------------------|----------------------| | Construction | 1% - 3% | $500k - $5M | | Landscaping | 1% - 1.5% | $200k - $500k | | Electrical | 2% - 4% | $300k - $1M |

Frequently Asked Questions (FAQs)

What Is the Process for Obtaining a Contractor Bond?

To obtain a contractor bond, you'll need to apply through a surety company or broker who will assess your financial standing and project requirements before issuing the bond.

Do I Need Multiple Types of Bonds?

Yes, depending on project requirements and local regulations, you may need multiple types of bonds such as performance and payment bonds.

Can I Get a Bond With Bad Credit?

While having bad credit may complicate obtaining a bond, it's not impossible. Some sureties specialize in high-risk clients but expect higher premiums.

Are There Alternatives to Contractor Bonds?

Alternatives include cash deposits or letters of credit; however, these options do not provide the same level of protection as bonding insurance for contractors does.

How Long Does It Take To Get Bonded?

The process can vary but typically takes anywhere from a few days to several weeks depending on documentation completeness and underwriting processes involved.

What Happens If A Claim Is Filed Against My Bond?

If a claim is filed against your bond due to non-compliance or failure to deliver services satisfactorily, you may be responsible for reimbursing the surety company after they settle any claims payouts.

Conclusion

Navigating through the landscape of contractor bonds doesn't have to be overwhelming. By debunking common misconceptions about their costs and processes surrounding bonding insurance for contractors, we empower professionals within this industry with knowledge that leads to better decision-making. Understanding these intricacies allows contractors to approach projects with confidence while safeguarding their businesses and reputations effectively. As many still harbor doubts regarding contractor bonds' necessity or expense implications, educating oneself on this topic becomes invaluable—ensuring you're always one step ahead in both securing projects and maintaining client trust.

In summary, while misconceptions abound about contractor bonds' costs and significance within construction agreements—being well-informed enables clearer pathways toward success in any contracting endeavor!