Choosing the right contract bond provider is a critical decision for contractors, businesses, and individuals who need to secure bonds for various projects. This comprehensive guide aims to provide you with the essential insights you need to make an informed choice. A contract bond acts as a guarantee that the obligations specified in a contract will be fulfilled. Hence, understanding how to select the best provider can save you time, money, and stress.

Understanding Contract Bonds

What Is a Contract Bond?

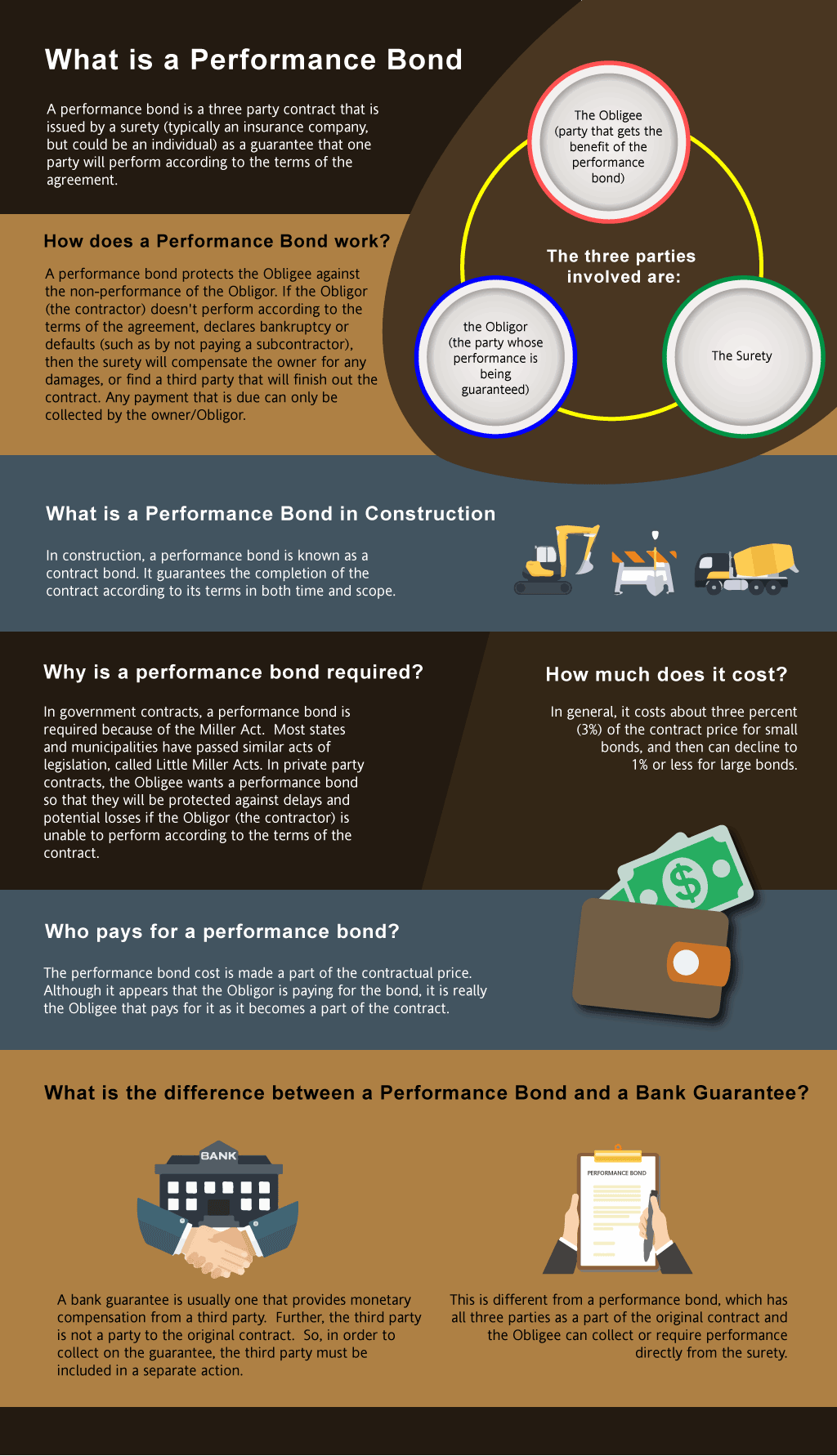

A contract bond is a type of surety bond that ensures that contractors fulfill their contractual obligations. If a contractor fails to meet their obligations, the bond provides financial security to the project owner or client.

Types of Contract Bonds

Bid Bonds: These are submitted with bids to ensure that if awarded the contract, the contractor will accept it. Performance Bonds: These bonds guarantee that the contractor will complete the project according to terms and conditions. Payment Bonds: They ensure that subcontractors and suppliers are paid for their work. performance bondsImportance of Contract Bonds

- Financial Security: They protect clients from financial loss. Reputation: Having a bond indicates credibility and reliability. Legal Requirement: Some projects require contractors to have bonding.

What to Look for When Choosing a Contract Bond Provider

When selecting a contract bond provider, there are several factors worth considering.

Experience and Expertise

Industry Experience Matters

The experience level of your chosen provider can significantly impact your bonding process. Providers with ample industry experience often possess deeper insights into market trends and challenges.

Specialization in Your Industry

Different industries have unique requirements when it comes to bonding. Ensure your provider has expertise in your specific field—whether it’s construction, manufacturing, or service-oriented sectors.

Financial Stability of the Provider

Assessing Financial Health

A financially stable performance bonds in construction bonding company is more likely to honor its commitments. Look at their ratings from agencies like A.M. Best or Standard & Poor's.

Reviewing Claims History

Investigate how often claims have been filed against them in the past. A high number may indicate potential risks associated with their services.

Customer Service and Support

Accessibility of Representatives

When issues arise during projects requiring bonds, having responsive customer service is crucial. Test their responsiveness by contacting them before making your decision.

Guidance Through Processes

A good provider will offer consultation throughout the bonding process. They should assist you in understanding necessary documentation and requirements.

Evaluating Provider Terms and Conditions

Understanding Bond Premiums

What Are Bond Premiums?

Bond premiums are fees charged by providers for issuing bonds, typically expressed as a percentage of the total bond amount.

Comparative Analysis of Premium Rates

Don’t just settle on one quote; gather multiple quotes for comparison but remember that low premiums may not always indicate quality service.

Reviewing Exclusions and Limitations

Identifying Exclusion Clauses

Exclusions can severely limit what you're covered for under your contract bond. Thoroughly read through all documents to understand what scenarios may not be covered.

Limitations on Coverage Amounts

Check if there are caps on coverage amounts which might leave you vulnerable in case of larger claims.

Researching Reputation and Reviews

Online Reputation Checks

Utilize online platforms such as Google Reviews or Trustpilot to assess customer satisfaction levels with various providers.

Word-of-Mouth Recommendations

Ask fellow contractors or business owners about their experiences with specific bonding companies; personal referrals can provide invaluable insights.

Regulatory Compliance & Licensing Requirements

Ensuring Compliance with Local Laws

Ensure that your chosen provider complies with local laws regarding contract bonds—this might differ from state to state or country to country.

Licensing Verification Process

Verify that they hold appropriate licenses required by regulatory bodies governing bonding activities in your region.

Cost vs Value Proposition Analysis

Breaking Down Total Costs

Analyze all costs involved—not just premiums but also administrative fees or additional charges applicable during claim processes.

Value Beyond Price

Consider other aspects like customer support, ease of claim processes, or additional services offered alongside standard bonding solutions when evaluating value propositions.

FAQs

Q1: What types of contracts require bonds?

A1: Typically construction contracts require bonds; however, contracts across various sectors such as healthcare or event management may also necessitate them based on state regulations or project specifics.

Q2: How long does it take to get a bond issued?

A2: The timeline can vary depending on documentation completeness but generally ranges from one day up to several weeks based on complexity and underwriting processes involved.

Q3: What happens if I can't fulfill my contractual obligations?

A3: If you fail to fulfill obligations outlined in a contract secured by a bond, the surety company pays out claims made against it but will seek reimbursement from you afterward—it's crucial you understand these implications thoroughly before proceeding!

Q4: Can I obtain multiple bonds from different providers?

A4: Yes! You can seek multiple bonds from different providers; however, ensure that each meets specific project requirements without conflicting issues arising between them!

Q5: Are there alternatives available instead of using bonds?

A5: Yes! Alternatives exist such as letters of credit; however these often come attached with different risk levels compared against traditional surety bonds so weigh options carefully!

Q6: How do I calculate my potential bonding needs?

A6: Calculating bonding needs involves assessing total project costs while factoring contingency allowances for unexpected expenses—consultation from experienced professionals can help clarify exact figures needed!

Conclusion

Choosing a contract bond provider requires careful consideration of various elements including experience, financial stability, customer service quality, terms & conditions, reputation checks among others detailed throughout this guide! It's vital not only ensure compliance with legal standards but also align choices according individual business needs effectively mitigating risks involved! Always remember—investing time upfront pays dividends later down line ensuring successful project execution without unnecessary hassles arising later!

By following these guidelines laid out here today when thinking about “What To Look For When Choosing A Contract Bond Provider,” you'll be well-equipped making sound informed decisions ultimately benefiting both yourself clients alike!